Tornado Damage Insurance Claim Tips to Remember

A tornado as strong as a EF5 multiple-vortex tornado does not happen all the time. Yet, even tornadoes of lesser strength can bring about great damage to various structures especially a supercell storm that can become a tornadogensis. A tornado is born out of an enormous and volatile thunderstorm coupled with wind shear. Some regions experience the huge mesocyclone type of tornado. Though smaller in scale compared to an EF5, a satellite tornado is equally damaging as it has the potential to merge with accompanying tornadoes.

The physical damages left behind by a tornado are a without a doubt horrific. People may lose their homes, livelihoods, and loved ones in just a matter of minutes. The trauma is truly indescribable. The task of rebuilding can be overwhelming especially for anyone who has just lost everything. This kind of a calamity can bring a heavy financial burden.

Though it will be difficult to deal with tornado damage, it is important to be steadfast. Despite the emotions that you might feel, keep your head clear. You need to be able to think straight so that you can sort things out properly. Immediately after the tornado has cleared, for instance, you need to have the sense to document everything for your insurance claim. Your insurance coverage, if it includes coverage for tornado damage, will take some of the financial burden off your back.

Experts advise victims to keep the following tips in mind and to take action in order to start the process of putting their lives back in order:

- As soon as it safe to go back to the property, take into account all of the damages incurred. If possible, document these using pictures or videos. Afterwards, get in touch with the insurance agent or company to discuss the likely scope of the repairs left behind by the catastrophe.

- Take note that it is alright to carry out minor repairs even before an insurance claim has been settled. Just remember to write down all of the expenses made and keep the receipts from purchases made that are related to the repairs.

- In the event that major repairs would be required, it is best to have these assessed soon so that work can be scheduled immediately. Furthermore, when hiring contractors for the job, be cautious of scams as some would still take advantage of people even in the face of misfortune.

- Make it a point to be available when the adjuster from the insurance company inspects the damaged property. Take this opportunity to inquire about any financial assistance the company may be able to provide its loyal clients.

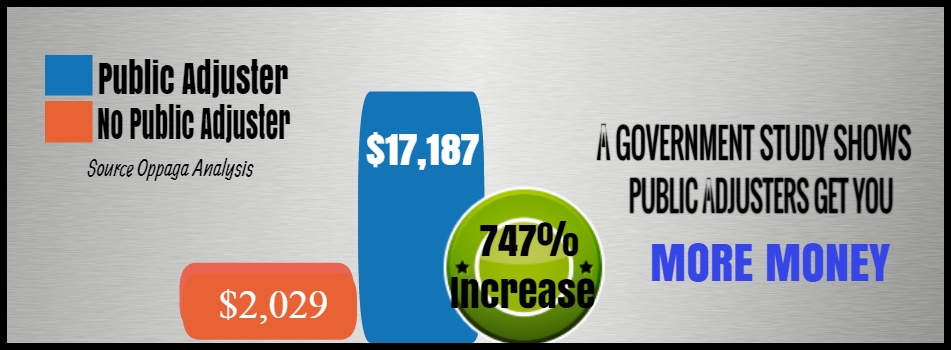

It would be in the best interest of the distressed party to seek the assistance of a professional insurance claims adjuster who can interpret their policy, appraise the cost of damages and repairs, as well as negotiate with the insurance company on their behalf. The work of a public adjuster is not over until the claim has been resolved.

However, hiring the services of an insurance claims adjuster is a debatable issue. Some consider public adjusters as more of a nuisance rather than as a necessity. In any situation, it is best to make an informed decision so as not to make matters worse and also to guarantee a speedy recovery.