5 things for a fire damage Insurance Claim

A Fire damage insurance claim caused by the disambiguation and oxidation of a burning fire is at times the worst experience a person can experience. The flame intensity which destroys the personal property and structural damage to a home or commercial business is devastating.

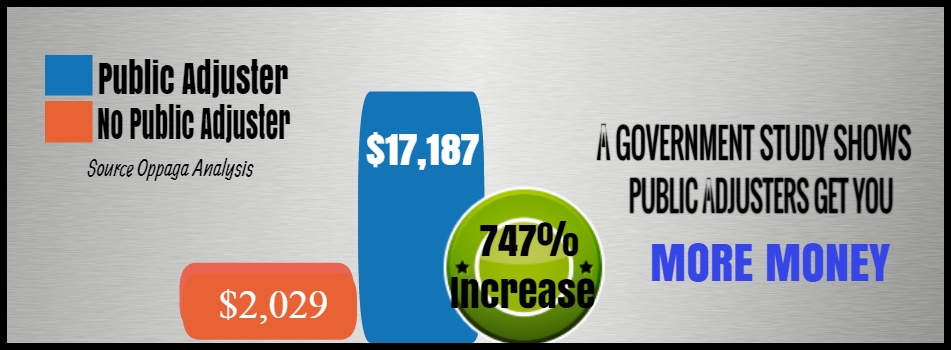

What’s worse is that homeowners try and settle their claim with the insurance company most times with no help from a private claim adjuster. Unfortunately, the insurance adjuster sent by the insurance company is obligated to protect the interest of the insurance company that employ’s them.

The real problem is that most people that experience an unfortunate event like a fire oftentimes are in shock and is really clueless as to what a fire claim adjuster does.

It is a very smart move to hire an independent claim insurance adjuster that is skilled and knowledgeable about preparing the fire damage insurance claim according to the guidelines of NAIPA which will comply with the insurance rules, regulations and laws.

There are 5 things you should do should you ever have fire damage.

- Employ an independent fire claim adjuster that will work with the insurance company on your behalf.

- Contact your insurance agent and give notification of the fire so the claim can be opened.

- Make sure the private insurance adjuster is licensed in the state and is in good standing.

- Make sure you search for his reputation online. See what others are saying about the fire adjuster you have chosen.

- Make sure you give your adjuster the insurance policy so that your coverage can be clear and the fire insurance adjuster can complete your claim with less problems as possible.

The end result of a fire is smoke damage to clothing, furniture, appliance, and walls. Always take the advice of the adjuster as it pertains to getting the information needed to complete the claim.

The severity of the fire is of utmost importance in the computation of the damages done to the personal property and structural damage. In some cases water damage is also an issue because when the fire is extinguished by the fire department the property is damaged more by the water that firemen leave behind to put the fire out. The combustion from the flame can destroy everything in its path.

Knowing what is covered by insurance and what is not covered is the most misunderstood issues among policyholders who have any kind of fire damage to their home, car, or commercial property. Regrettably, the insurance company will not disclose all of the losses that you may be entitled to receive as a result of your loss. So having a public adjuster to evaluate and prepare your fire damage claim for the insurance company is pivotal and crucial to you receiving the funds that you are due in a timely manner.

The adjuster will know if you need fire or water damage restoration. Nothing will top the knowledge of the public adjuster when it comes to preparation and submission of your claim that is done according to the insurance laws of your state. Always remember that your private insurance claims adjuster hired by you is on your side. The fire claim adjuster will make sure you get the most money from your claim and represent you properly with the insurance company.