When was the last time you read and understood the insurance policy that covers your home or business?

- Many people have difficulty understanding the technical language of the insurance policy and the complicated procedures they must follow to comply with the policy’s terms.

- Most people do not realize that insurance company adjusters are trained professionals who represent the interests of the insurance company which employs them.

- You can protect your interests by employing an accredited public adjuster whose sole responsibility is to serve you, the insured.

- Accredited public adjusters are retained for the adjustment of insured claims due to fire, wind, water, vandalism, and other perils. The public insurance adjuster serves commercial businesses, financial institutions, professional firms, homeowners, and the general insuring public.

- If a loss occurs, you should give immediate consideration to engaging the services of a public insurance adjuster, specifically one accredited by the National Association of Public Insurance Adjusters (NAPIA). This question and answer section will help you understand how a public insurance adjuster works for you.

- What is a public insurance adjuster?

- A Public Insurance Adjuster is an authority on loss adjustments who helps the consumer with preparing, filing, and adjusting your insurance claims.

- What is meant by the term “accredited” public insurance adjuster?

- It means that the public insurance adjuster acts according to a strict code of ethics established byNAPIAand is an accredited member of the Association.

What is NAPIA?

NAPIA stands for the National Association of Public Insurance Adjusters. NAPIA members are experts in the profession of public insurance adjusting who have joined together for the express purpose of professional education, obtaining certification and promoting a rigid code of professional conduct and ethics.

Are they connected with insurance companies?

No. They are employed exclusively by you – the policyholder- not by an insurance company.

How can an accredited public insurance adjuster help me?

You will have the advantage of expert assistance based on great experience in handling numerous technical problems. Your public insurance adjuster relieves you of the many time-consuming and difficult matters involved in preparing and filing a claim – and helps you to receive a prompt and fair settlement.

Can I prepare my own claim?

Sure, but it stands to reason that the accredited public insurance adjuster who has years of experience and training can do so with more competence than the policyholder.

More specifically, a public insurance adjuster will assist you in the preparation of inventories, estimates and other factual proofs of loss. He or she will handle all the necessary details for compiling and filing claims, as required by the terms of your insurance policies. Your public insurance adjuster will also confer, on your behalf, with insurance company representatives and handle all matters essential to a proper and satisfactory adjustment.

Why do I need help in filing an insurance claim?

The typical fire policy contains hundreds of provisions and stipulations – various forms and riders that are constantly changing and many complex details about your requirements in case of loss. Most people do not know or understand these policy provisions – and most do not realize that the burden of proof is on them, the policyholder. Most insurance company representatives actually prefer to work with an experienced accredited public insurance adjuster rather than an inexperienced insured.

An accredited public insurance adjuster not only has your confidence, but also that of company adjusters who recognize that they are dealing with a professional.

In the event of a fire or similar destruction of property does my insurance pay the entire loss?

This depends upon the type and amount of insurance you carry. It also depends on your expertise or the expertise of your representative, not that of the insurance company’s adjuster. Many insurance policies may pay more than the amount shown on the declaration page. A qualified expert working for you can determine everything to which you are entitled.

Why should I engage a public insurance adjuster to obtain what is rightfully due to me?

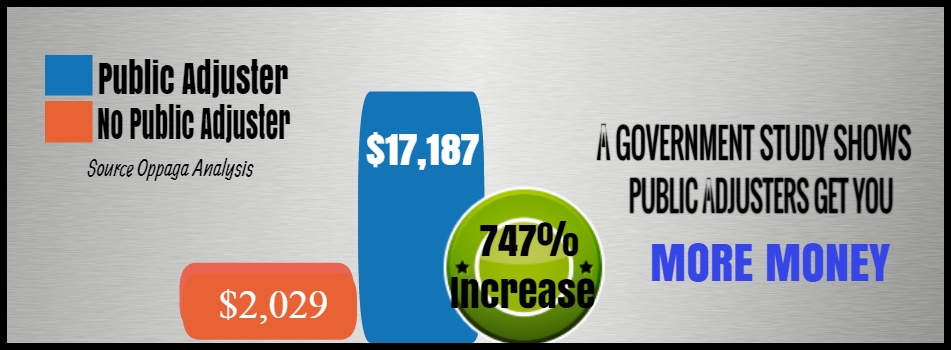

Insurance companies offer to pay what is due to you as they see it. Public insurance adjusters are your exclusive representatives. With their experience and knowledge they are better able to obtain a more favorable adjustment for you, the insured.

What is the extent of their responsibility?

Your public insurance adjuster assists with every phase of preparing and presenting your claim, as well as accomplishing an adjustment for you which is equitable and includes everything to which you are entitled under your insurance policy.

How do they determine the actual loss?

They take a physical inventory, obtain all pertinent appraisals and make sure all provisions in your policy are properly fulfilled. This often involves numerous steps of which you may know little or nothing, but can make a significant difference in the amount of the final adjustment.

What special help can the accredited public insurance adjuster give me with technical questions?

They are the experts to turn to when such matters arise. They are concerned only with your interests. Because of their broad experience and specialized knowledge, they prepare your claim so that you can recover to the fullest extent on your insurance coverages. It is up to you to prove your loss. There may be many questions and problems as to how the policy provisions can be applied in different circumstances.

Are they trained specialists?

Yes. Your NAPIA public insurance adjuster must, in virtually all jurisdictions, be tested, licensed, bonded, and authorized to practice his/her profession. All members are accredited by NAPIA. Furthermore, a Certified Professional Public Insurance Adjuster (CPPA) must have a minimum of five years experience and pass an examination to earn certification. A Senior Professional Public Adjuster (SPPA) must have a minimum of ten years experience and also pass a rigid examination to earn “senior” certification. Both are required to continue their professional education to keep up with changes in the insurance industry so they can best serve you.

When you deal with a NAPIA member public insurance adjuster you can be confident that your claim is being adjusted by a fully-qualified professional.

How much time will it take to settle my claim? If I hire a public claims adjuster, will this cause more time delay?

A great deal of Insurance Companies have a two phase approach to this. The first step is to see if they can quickly settle the claim for an amount considerably less than what you deserve. And if they don’t feel that they can accomplish this goal, then they try to see how long they can drag the claim out. There is a very interesting book titled, “Delay, Deny, Defend” which outlines these tactics and more. Hiring a Public Adjuster will expedite your receipt of a fair settlement. We can assure you that we will work as fast as we can, but not too fast as to fail to do a thorough job. We take as much time as needed to ensure that you have received everything you are entitled to, based on your loss and the coverages you purchased.

Will a public insurance adjuster help me receive a more prompt and satisfactory settlement?

Yes. They lose no time in complying with the policy requirements to obtain and evaluate the facts and prepare the claim. The alert, knowledgeable and prompt service they render often preserves evidence that may otherwise be overlooked or destroyed. The more thoroughly and completely your claim is compiled and prepared, the faster your public insurance adjuster can accomplish an equitable and proper settlement in you best interest

Once a policyholder has witnessed the skill and knowledge of the accredited public insurance adjuster, he or she rarely will attempt to settle a claim without the benefit of their specialized assistance. The public insurance adjuster’s most frequent sources of new clients are the recommendations of those they have previously served.

Can the contractor who is doing the work on my home negotiate my claim with the insurance company?

This is not allowed in the state of Missouri, even if your contractor is a licensed public adjuster. Contractors are not permitted to perform repairs on claims they represented you as a public adjuster on. Another thing to keep in mind is that a contractor that illegally negotiates with your insurance company may limit his negotiations to things that will only compensate him. We have run into many situations where contractors have tried to keep the damages low to guarantee them work

How much should I expect to pay a public adjuster for his work?

There is no upfront cost for the adjuster’s services. You can expect to pay a public adjuster with a percentage of the insurance company’s settlement.

By seeking to maximize your settlement, your public insurance adjuster’s services can save you the cost of their fees. The amount you pay the adjuster will depend upon the size and complexity of your loss.

If you had your choice of whom was going to decide how much your insurance company was going to pay you, would you want it to be someone who was looking out after your best interests or the insurance company’s bottom line?

Do I still need a Public Adjuster when I already have an Independent Adjuster working on my claim?

This independent adjuster isn’t really independent and doesn’t work for you, but the insurance company. An independent adjuster, is not independent or impartial, he just works for more than one insurance company. He is not licensed in the State of Missouri, like a public adjuster. The independent adjuster represents insurance companies and not the policyholder. Their income is provided by the insurance company that they represent. On the other hand, a Public adjuster is licensed and bonded specifically to only represent individuals and/or businesses that have suffered a loss. They are hired by you, and have a fiduciary responsibility to make sure that you receive the maximum benefits available under your policy of insurance.

I have family members or friends that are offering to help me. Can they do the same thing a public adjuster can?

Yes, if they are also public adjusters. Public adjusting is a very specialized skill. In most states there are less Public Adjusters than Brain Surgeons. Even friends or relatives who work or worked for insurance companies, can’t do what a public adjuster does. Primarily, because they have been trained to adjust losses in a way insurance companies like losses adjusted. Public adjusters have been trained to accurately document your damages. Public adjusters don’t ask for unreasonable repairs, but if there is any question as to the property way to repair damaged property they lean towards the more extensive repairs, as opposed to the least expensive ones.

I decided to try to settle my claim on my own and I am not sure that I have received a fair settlement. What should I do?

If you call us we can review your settlement and we will give you our honest opinion for no charge. Normally policyholders will call and ask for a review of the settlement, as there can be many issues involved in the property loss adjustment process. You can always call to have us evaluate your settlement. But, we can actually perform this evaluation with you before your insurance company inspects your property. Most people are just like you and don’t know what they should receive. This makes it extremely difficult for them to determine if their settlement is fair. Normally in a 15-20 minutes meeting, immediately following a loss, we can help you understand the full extent of your damages.

I have already accepted payment on my claim but I feel that I am entitled to more than what the insurance company paid me. Can a Public Adjuster help me in such a case?

This may be possible, even after releases are signed, there are certain claims that can be reopened with additional payments made to the home or business owners.

There is no fee to contact a public adjuster to review the claim and see if there is anything more that you can do if you feel you may be entitled to more than what the insurance company paid you.

In the event of a loss, what steps should I take?

Promptly report the loss to the agent or broker, or directly to the insurance company – and immediately retain the services of an accredited public insurance adjuster to serve you.

Do public insurance adjusters take care of claims other than fire?

Yes. They will assist you in any claims you may have due to windstorm, explosion, and any other insured losses that are sustained (inland marine, business interruption, rental income, improvements and betterments, commission and profit, reporting forms, additional expense, etc.).

Can I meet with a public adjuster BEFORE I have a major problem so that I may better understand what my insurance policy does and does not cover?

Yes you can and it is a smart idea to do so. When you get to know how your policy works you will then learn if there is anything that you need to change. Then you can meet with your insurance company and improve your coverage to your satisfaction. Most insurance agents don’t get directly involved in claims, while public adjusters are intimately familiar with the process. Knowing the process and how the insurance company adjusters interpret the policy, can drastically affect how your claim is handled.

Do they sell insurance or act as insurance agents?

No! If they were to do so, they would become a representative of the insurance company – and they would no longer represent you exclusively and independently.

Must I have a large insurance claim in order to get assistance from a public adjuster?

Size doesn’t matter. You can get assistance from a public adjuster on any claim. Also the larger your deductible or if you have an Actual Cash Value Policy, it is more imperative to be properly represented by a public adjuster.

If I have a problem or complaint concerning an adjuster or insurance company what should I do?

State insurance departments license insurance companies, brokers, agents, and adjusters to operate in their state. If you feel that one of these licensees has failed to act in accordance with your contract or state insurance law and regulation, we urge you to contact your state insurance department in writing, setting forth the nature of your complaint.

What if I have a question about insurance coverage or the insurance industry?

State insurance departments are also the appropriate place for information about licensees, insurance law and regulation