What We Do-Insurance Public Adjusters

Our licensed and Experienced Public Adjusters have years of expertise in giving assistance to all kinds of insurance claims which include: vandalism/theft, water, fire, flood and tornado damage. Call us for any property damage and we will guide you on how to properly mitigate the loss and proceed as per your insurance policy. Our experienced public adjuster will be at your home or business for evaluation of your loss within minutes in the event of an emergency. Our team of experts includes Public Adjusters, Attorneys, Contractors, Mediators and Engineers. We have gathered the best professionals to provide the top claim representation.

We perform the following professional services:

- Evaluate existing insurance policies in order to determine what coverage may be applicable to a claim Research, detail, and substantiate damage to buildings and contents and any additional expenses.

- Evaluate business interruption losses and extra expense claims for businesses

- Determine values for settling covered damages

- Prepare, document and support the claim on behalf of the insured

- Negotiate a settlement with the insurance company on behalf of an insured

- Re-open a claim and negotiate for more money if a discrepancy is found after the claim has been settled.

- Typically a policyholder hires a public adjuster to document and expedite their claims, obtain a more satisfactory claim recovery, more quickly, and completely restore their residence or business operations, and insulate themselves from the stress of engaging in an adversarial role with a large corporation. However, the cost of hiring outside experts, no matter how well-earned, can be an added burden when they are borne entirely by the policyholder. The added burden can be alleviated by the work of a public adjuster. However, policy holders who are not properly indemnified by their insurance carriers may be left with little choice but to hire professional assistance to recover the claim payment to which they are entitled.

Public adjusters must be able to recognize claims that may be insubstantial and disputable and explain such problems to the client. The everyday meanings of terms like “collapse”, “partial collapse” and “extent of physical damage” might be entirely different from their legal interpretations, requiring the adjuster to clarify such terms for the client. Regulations regarding the uses of these terms are constantly in a state of flux[15] so it is important for public adjusters to have a firm grasp of the law including the division of legal responsibilities between insurance companies and policyholders.

Settling Insurance Claim through Public Adjuster

The stress brought by property loss can be very overwhelming to the owner. Additional problems arise if the property owner does not have the knowledge and time to properly perform an insurance claim. There are actually professionals who can help those people who are undergoing such kind of insurance problems. They are called insurance adjusters.

There are actually 3 types of adjusters and they are categorized based on whom they are working for. These are the staff adjusters, independent adjusters and the public adjusters. Both the staff and independent adjusters are hired by the insurance companies. The public adjusters, on the other hand, represent the policyholder or the claimant of the insurance. This article will focus on the role of public adjusters.

Adjusters are also popularly known as insurance loss assessors. Public adjusters are sought by policyholders due to a number of reasons. Such type of adjuster can help to evaluate the insurance policies. In this manner, they will be able to know the rightful amount of coverage that can be claimed by a policy holder. Documentation of the property loss is also one of their responsibilities. Documentation of a property loss is a very tedious task and must only be handled by professionals who can negotiate settlement with the insurance companies.

Public adjusters can also help policyholders to evaluate their losses in terms of business interruptions and other extra expenses that can eventually be claimed by the owner. If discrepancy is found in a previous insurance claim, public adjusters may also reopen the case and help the policyholder seek what is just for him.

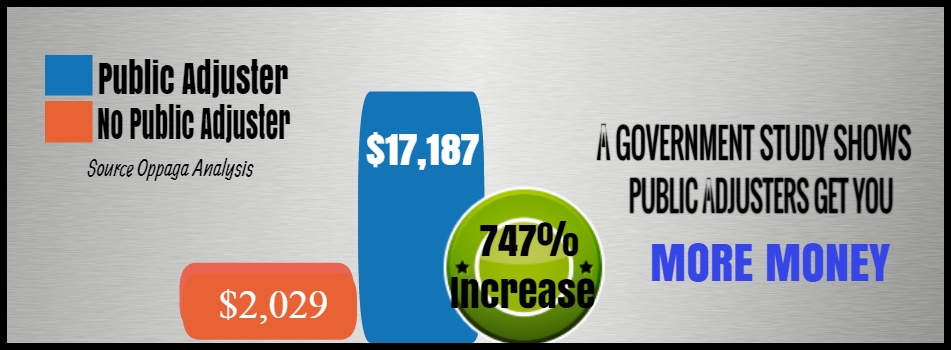

Basically, their role is to help the policyholder relieve the stress of filing an insurance claim that he does not have enough knowledge or experience in. With the help of public adjusters, there is a higher chance that policyholders can quickly and more satisfactorily claim an insurance and recoup their losses.

Hiring a public adjuster comes with a fee. They are usually paid based on the amount of the total settlement. Their fee is usually between 5%-10% of the total insurance claim. However, there are also adjusters who have a permanent percentage rate. In some states, there are policies mandating that the adjuster’s fee must be discussed up front so that policyholders can have an idea on the hiring fee that they should pay. For re-opened insurance cases, public adjusters may charge a higher fee because of the extra research and documentation needed to make a claim.

When is the time to seek the help of public adjusters?

When a claim for insurance is done, the usual process involves communication between a policyholder and a staff or independent adjuster. Once the insurance company receives the notice of a property loss, it will send an adjuster to investigate how the loss happened and the possible magnitude of the claim. It is very important to realize the fact that the adjuster sent to a policyholder is a representative of the insurance company. Any incorrect answer to their questions may greatly affect the amount of compensation that can be claimed by the policyholder. Hiring public adjusters may prevent these things from happening.

Hiring public adjusters will help the policyholder get a fair settlement from the insurance company. Public adjusters can already engage with the research process before a representative from an insurance company performs the fact-finding process. In this manner, inadequate and incorrect answers to the insurance company’s adjusters can be completely prevented.

There are several things that policyholders must consider when hiring adjusters. The most essential thing to consider is to make sure that the adjuster that they are hiring is a licensed one. It is not enough that they have the license. Policyholders must also ensure that their license is valid under the state where the claim is being negotiated. Policyholders must also make sure that the person they are talking with is the actual adjuster and not just a representative.

Being able to know if the adjuster that you are hiring is presently handling a lot of insurance cases is very important. This will help you determine if the adjuster can provide enough attention to your case or if he can be a cause of delay because of the other cases he is covering. Knowing more about the adjuster’s credentials and experience will also help a policyholder to determine if he is hiring the best among the others.

Policyholders may ask from the adjuster a list of reference for insurance cases that he had successfully handled in the past three years. The policyholder may call such references and validate if the adjuster had actually worked with them. Inquiring from the references if the adjuster was able to thoroughly guide them throughout the rebuilding and adjustment process and was able to seek additional value to the final settlement claim will help the policyholder to assess the adjuster’s skills and credibility.

When hiring public adjusters to help you in your insurance claim, it is always important not to rush in making the decision. You must take time to interview them and to research about them. Do not be hesitant to ask all the essential questions and assess if the adjuster is confident and well-knowledgeable in giving the answers. If you get caught in a dispute with your adjuster, you can contact the National Association of Public Insurance Adjusters to help you resolve the conflict. If this did not help, you can also file your complaint with the state regulator.

WE ALSO PROVIDE A FREE INSPECTION!!!

We are licensed in the following states:

Missouri click here to lookup license

Illinois: License Lookup

Michigan: License Lookup