The Water Damage Insurance Claim Process

If your property has been damaged by water leaks or floods, the next best thing for you to do is to file an insurance claim to help you defray the costs of repairs and restoration. Depending on what’s included in your insurance policy, you can make a claim for water damage loss. This kind of coverage would usually give cash indemnity for repairs, restoration, or even replacement.

The Claim Process

Filing an insurance claim usually comes at a time when you are already in a dire state and are in need of immediate financial assistance. Whether you were a victim of nature’s wrath and your property was submerged in flood waters or your pipes simply sprung a leak and flooded the basement, you would not want to have to fight with your insurance provider just to get financial assistance. You would want the claim process to go smoothly without a hitch so that you can get the funds to fix your property immediately.

The process of filing an insurance claim should not be such a hassle. The first thing you have to do is to contact your insurance agent as soon as possible. Be ready with the necessary information such as your insurance policy number and your address. You will also need to provide the details of the damage or loss. It would be a good idea to have a list of all the documentary requirements as well so that you can compile them ahead of time. The insurance company will most likely send a licensed and accredited claims adjuster to assess the damage to your property.

The next step is to document your loss. Make a detailed list of all the items or house parts that sustained water damage. You will have to put a value to each item on your list. If you have the receipts from when you purchased these items or credit card bills proving the value of these items, you can use these as evidence of their value. If these are not available, give an estimated value and note the date and place of purchase instead.

Take photos and videos of the areas that were damaged as well as the source of the water coming in. If the flood has subsided, you need to take a photo of the water mark on the wall. This will serve as evidence of how high the flood water reached. Do not attempt to clean and restore the area until after the insurance adjuster has completed inspection of your property. Do not throw any damaged item without the go signal of adjuster as well.

If you had to stay at an inn or hotel because your home was unlivable because of the damage, you should keep the receipts of all expenses including the hotel rate, the meals, and other expenses that you incur. Your contract might entitle you to a reimbursement of these costs. Receipts for any other materials that you use to clean up and restore the damaged area should also be kept for possible use later on.

All the paperwork should be accomplished before the claim will be processed. The insurance adjuster will file his own report with the insurance company after his inspection. He will detail the scope of damage and make an estimate of how much it would cost to repair, restore, or replace the damaged property. The insurance company will then make a disposition on your claim.

Some Precautions

In surveying the damage to your property, you have to remember to make sure that the area is safe for you to enter first. If there is still water on the floor, turn off all electricity. You or your family members could get electrocuted. Flood water should be removed from your home immediately as they also pose health hazards to your family. If water is still rushing in, you would have to find a way to stop it or contain it to prevent further damage to your property.

When you check for damages or damaged items, do it thoroughly. You need to inspect every nook and cranny to be sure that you do not miss anything when you file your documents. Amending your claim later on might not be such a good idea.

Having Repairs Done

When cash is a problem, it is often not possible to start repairs right away. In such cases, expediting the claims process becomes even more important. There are times when the insurance company and adjuster can recommend a contractor to help restore your home.

It would be a good idea to check your policy contract or ask your insurance agent about how the claim benefits will be disbursed. There might be instances when the cash might not be released all in one go. Some companies might make a partial release and then withhold the rest of the settlement amount until after the repairs have been completed.

Make sure that you only deal with a licensed contractor for your repairs. This is actually true for any kind of repair work in your house. This way, you are assured of quality work that will last for many years. You do not want to have the same damage happen again. Besides, some insurance policies will have limitations on how many incidences of water damage you can file claims for.

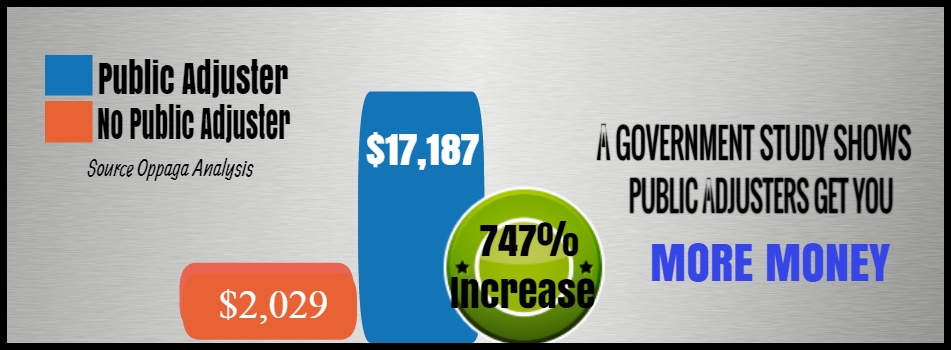

It is not inexpensive to deal with property damage due to leaks and floods. Having an insurance policy that includes water damage as a covered loss could save your bank account when this happens to you. A public adjuster can help you get what you need in your insurance claim.