Roof Damage Insurance Claims

Insurance claims

Insurance claim fire losses are formalized requests or applications submitted to insurance companies requesting for a payment or benefits based on the terms of the insurance policy. These claims are reviewed by the insurance companies depending on the type and validity of the insurance policy. The policy holders will have to first file claims to the insurance company before the company can send disbursement to any hospital, repair shops or other service providing companies. The insurance company can either approve or decline the claims based on their assessment of the circumstances or events. However, if the claim is valid and approved, the insurance company will pay out the servicing company in behalf of the party, or the policy holder himself.

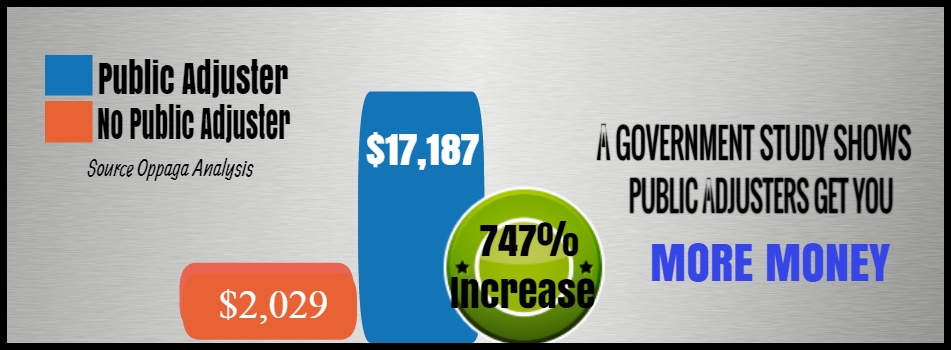

Insurance companies have insurance adjusters, property insurance adjusters, public adjusters or claims adjusters. These people help the claimants to appraise and negotiate their claims. They are responsible for property damage evaluation; they are the ones who talk to witnesses, claimants, and police officers, among others, and they are responsible for checking hospital records so they could determine the extent of the insurance company’s liabilities with regards to the repair estimates if they are right and reasonable for them to insure. This is also just to ensure that contractors are giving accurate estimations to the company and this method is also another measure to avoid possible fraud since a lot of contractors tend to over-estimate the costs to raise the compensation they stand to receive. In Australia, New Zealand, Ireland, the UK, the Caribbean, and South Africa, the term loss adjuster is used. Insurance companies rely also on the property insurance adjuster’s evaluation for their final say. Some adjusters can either work in behalf of the insurance company or in behalf of the policyholder.

Roof Damage Insurance Claim is a request individuals make when their roof has leaks, damages due to vandalism, fire, y hail storms, or simply damaged by other causes. Some of the common reasons for roof damage are leaks, corrosion, weather, wind, and wear and tear.

Leaks are one of the major causes for roof problems. They are usually caused by improper installation of shingles or gutters that aren’t draining well. They commonly happen when two separate parts of the roof meet, like in the pipes, walls, and chimneys. Once you see leaks, have it fixed as soon as possible to avoid complications such as black mold growth. Corrosion happens when the flashing has deteriorated in projections and roof valleys in vents, chimneys and skylights. Strong wind may cause the roof to curl up, lift or come off, and expose the vulnerable parts of the roof to allow water to enter.

The weather also plays a role in the roofing system. The extreme cold and hot temperatures, wet and dry seasons can eventually buckle, split or blister the roof and may create ways for moisture to get in the roofing. Holes in the roof caused by animals, fallen debris, or human weight can also contribute to the possible collapse of the roof. The Type of roof material may also indicate the durability of the roof. Most of the roof materials in the US are made of asphalt shingles because this is considered to be very reliable and the cost is affordable. Slate tile is one of the longest lasting materials. However, it is also heavy, and costly, plus the fact that it needs additional substructures to support the weight. Wood shake shingles are among the roof materials that have been around the longest. These are made from spruce, treated pine or cedar. Laminated or architectural shingles are modern types of fibreglass. There are newer roofing materials that are made from natural rock particles like resin and clay. They are fabricated to be non-moisture absorbing and fire-proof.

Hail Roof Damage Insurance Claim

What to do to claim roof damage insurance

First, you should check your home insurance policy and be sure that you are still covered by it. If you are still covered, call your insurance agent. The agent will file a claim in your behalf and will coordinate with an insurance adjuster to take a look at your roof. If your roof is shabby and in bad shape before the damages occurred, the insurance company may not approve your claim. Note also the date of the hail storm and look for articles to support your claims that there was indeed a storm.

While waiting for the results of your claim, you should keep in touch with your local roofing contractor to give you an estimate of the possible repairs and replacements to be done. In fact, to be sure that you really incurred hail roof damage, you should initially call your prospective contractors to verify the damages.

Most of the time, adjusters tie up with contractors just to make sure they are on the same page, especially when deciding on the estimation. Usually, the adjusters take photos and inform you what the next steps to take are. For some adjusters, they will give you a quotation right on the spot and some will take weeks to properly give you their expert advice. The job of the contractors and adjusters are somewhat connected. They will most likely compare the roof measurements just to make sure they are accurate when giving the quotation.

Just in case the insurance agent doesn’t agree that there is significant damage to the roof, have your contractor talk to the agent and try to settle on something. When your insuring company agrees to cover the roof damages, you could replace the roof as soon as possible.